student loan debt relief tax credit for tax year 2021

How much money is the Maryland Student Loan Debt Relief Tax Credit. Amounts canceled as gifts bequests devises.

Student Loan Debt Cancellation And Taxes Kiplinger

When the student is awarded with the tax credit up to 5000 they must use the credit to pay their college loan debt within two years.

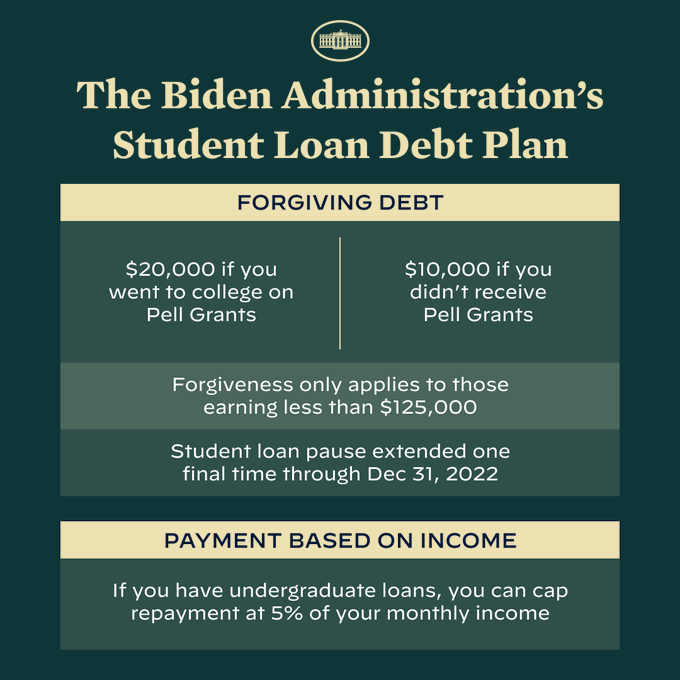

. On August 24 2022 President Biden Vice President Harris and the US. 2 days agoThe student loan delinquency rate for borrowers in Arizona was 87 at the end of 2021down 3 from the previous year. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years.

Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service. The state has a few loan repayment programs for. Department of Education announced announced a three part student loan debt relief plan to.

About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. Complete the Student Loan Debt. Otherwise recipients may have to repay the credit.

Have incurred at least 20000 in undergraduate andor graduate student loan debt. You may deduct the lesser of 2500. Were eligible for in-state tuition.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Credit for the repayment of eligible student loans. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. CuraDebt is an organization that deals with debt relief in Hollywood Florida. The fresh Student loan Debt relief Income tax Borrowing from Student loan Credit card debt relief Income tax Borrowing to own Taxation 12 months 2021 Finalized So it.

Recipients of the student loan debt relief. It was established in 2000 and has since become a. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

If the credit is more than the taxes you would otherwise owe you will receive a tax. An official website of the State of Maryland. Student loan interest is interest you paid during the year on a qualified student loan.

CuraDebt is a debt relief company from Hollywood Florida. Have at least 5000 in outstanding student loan debt upon. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the.

Mhec student loan debt relief tax credit program for 2021. It includes both required and voluntarily pre-paid interest payments. One begins to lose rest and feels pressured.

Under Maryland law the. About the Company 2021 Student Loan Debt Relief Tax Credit Information. You must claim Maryland residency for the 2022 tax year.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. It was founded in 2000 and is a. There isnt a set amount thats released for the.

More than 40000 Marylanders have benefited from the tax credit since it. Have the debt be in their the Taxpayers name.

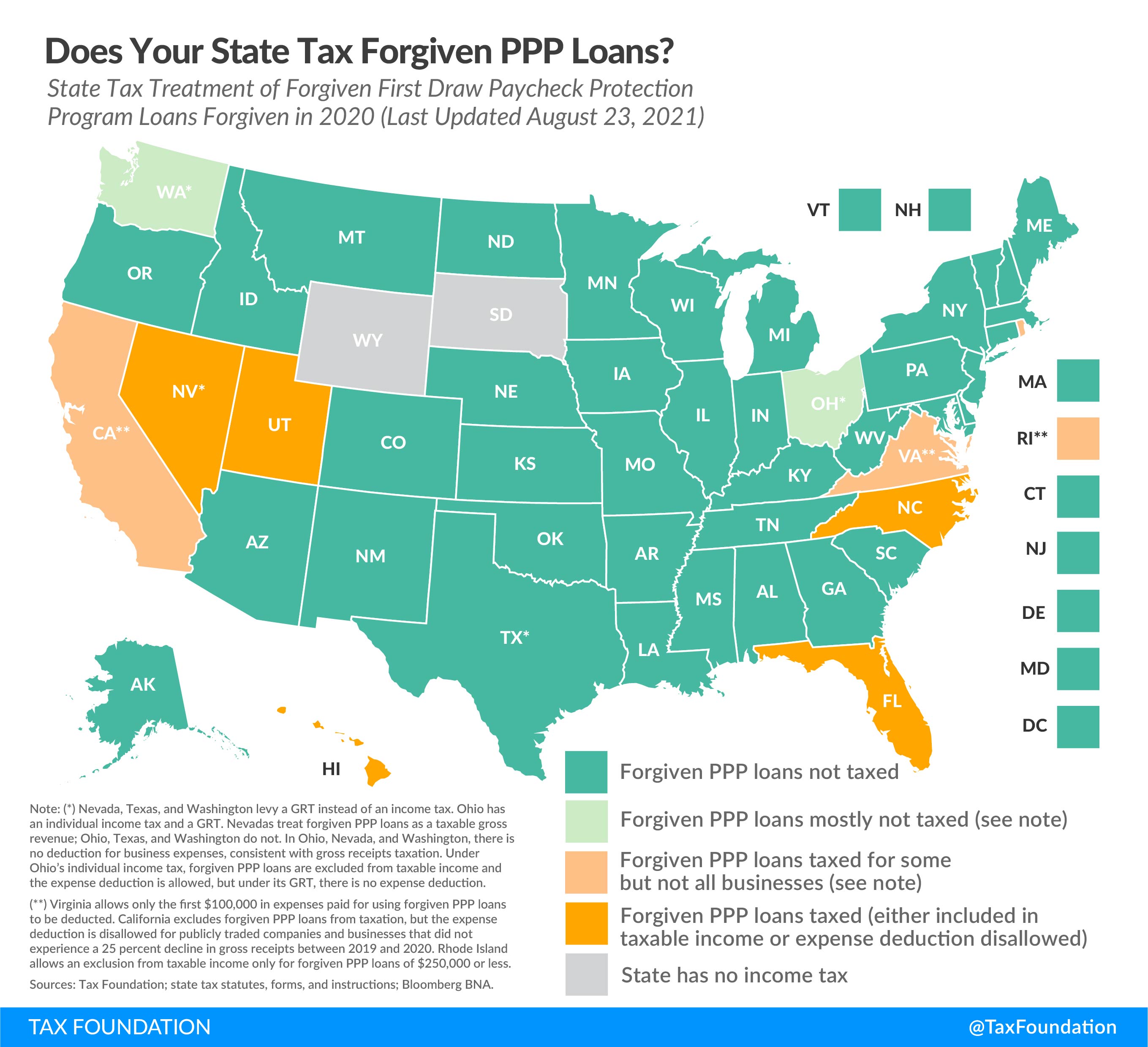

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

Biden S Stimulus Package Makes Student Loan Forgiveness Tax Free Bankrate

Student Loan Forgiveness Statistics 2022 Pslf Data

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

The Impact Of Filing Status On Student Loan Repayment Plans The Tax Adviser

Everyone Has Opinions About Student Loan Forgiveness Bloomberg

Biden To Cancel 10k In Student Loans For Many Borrowers

What Student Loan Tax Credit Can I Claim Frank Financial Aid

Tax Free Student Loan Forgiveness Is Part Of The Latest Covid 19 Relief Bill Hbla

Income Recertification Planning As Student Loan Freezes Ends

Can I Get A Student Loan Tax Deduction The Turbotax Blog

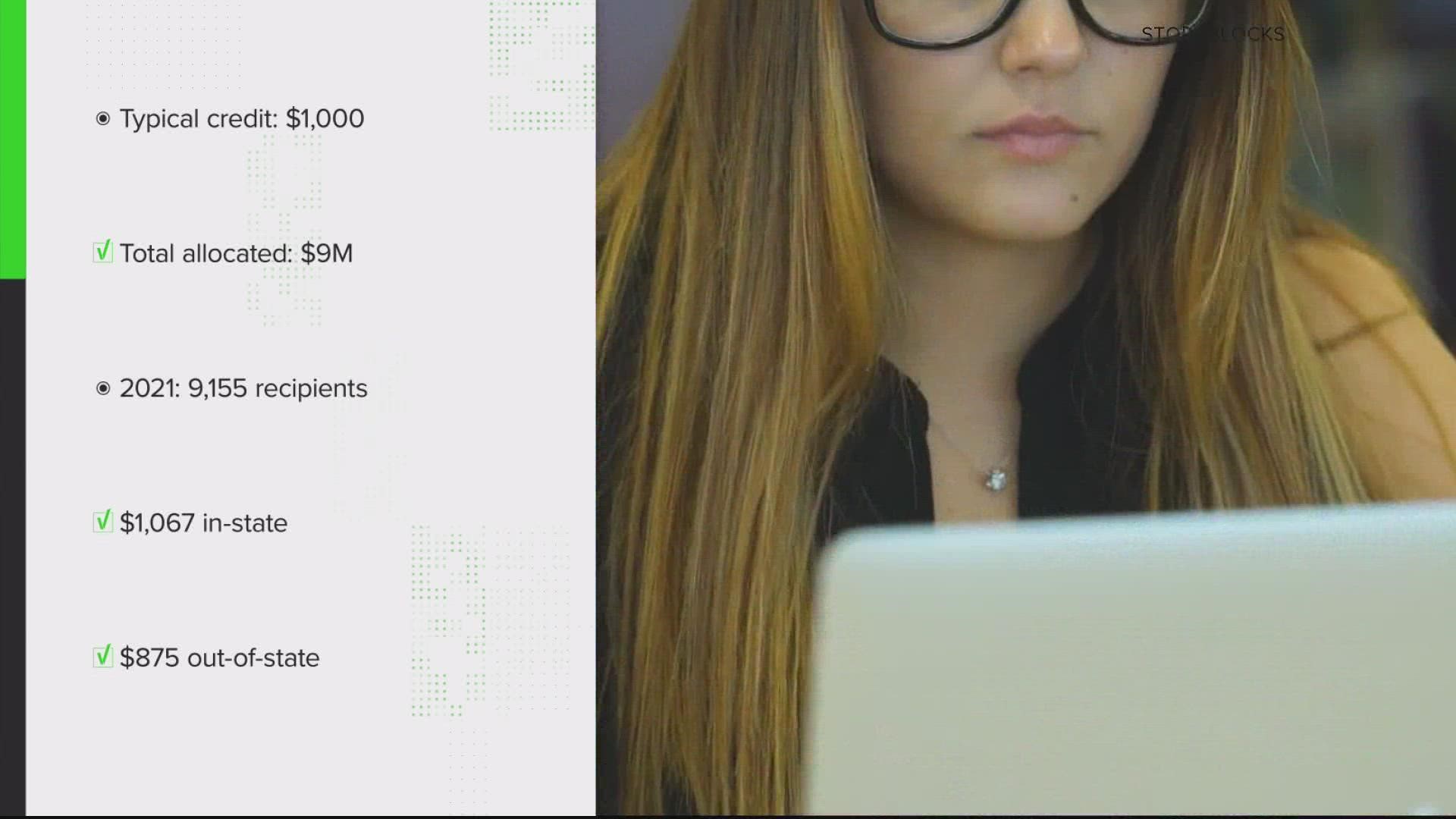

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

How Do Student Loans Affect Your Taxes Earnest

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

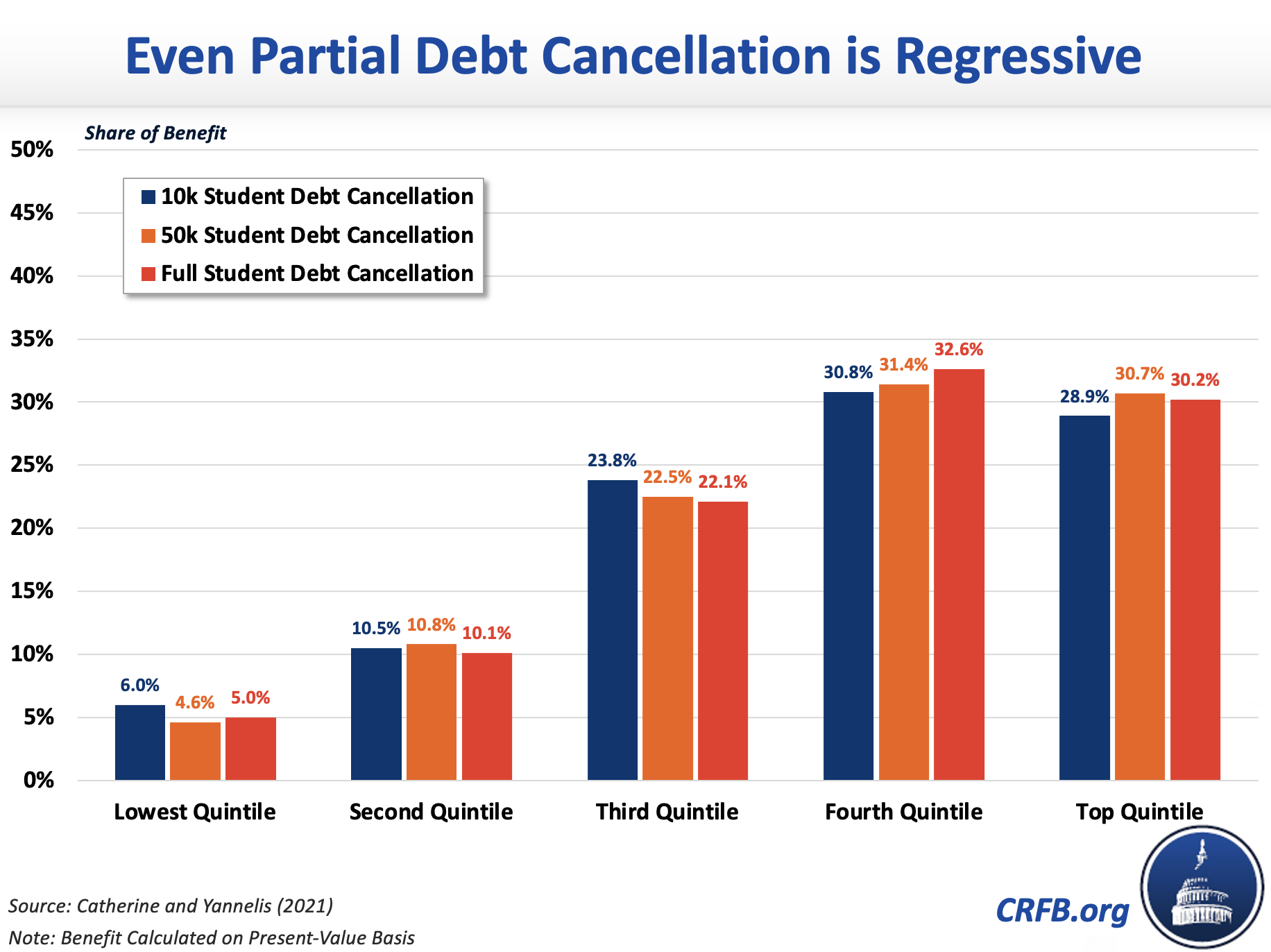

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget